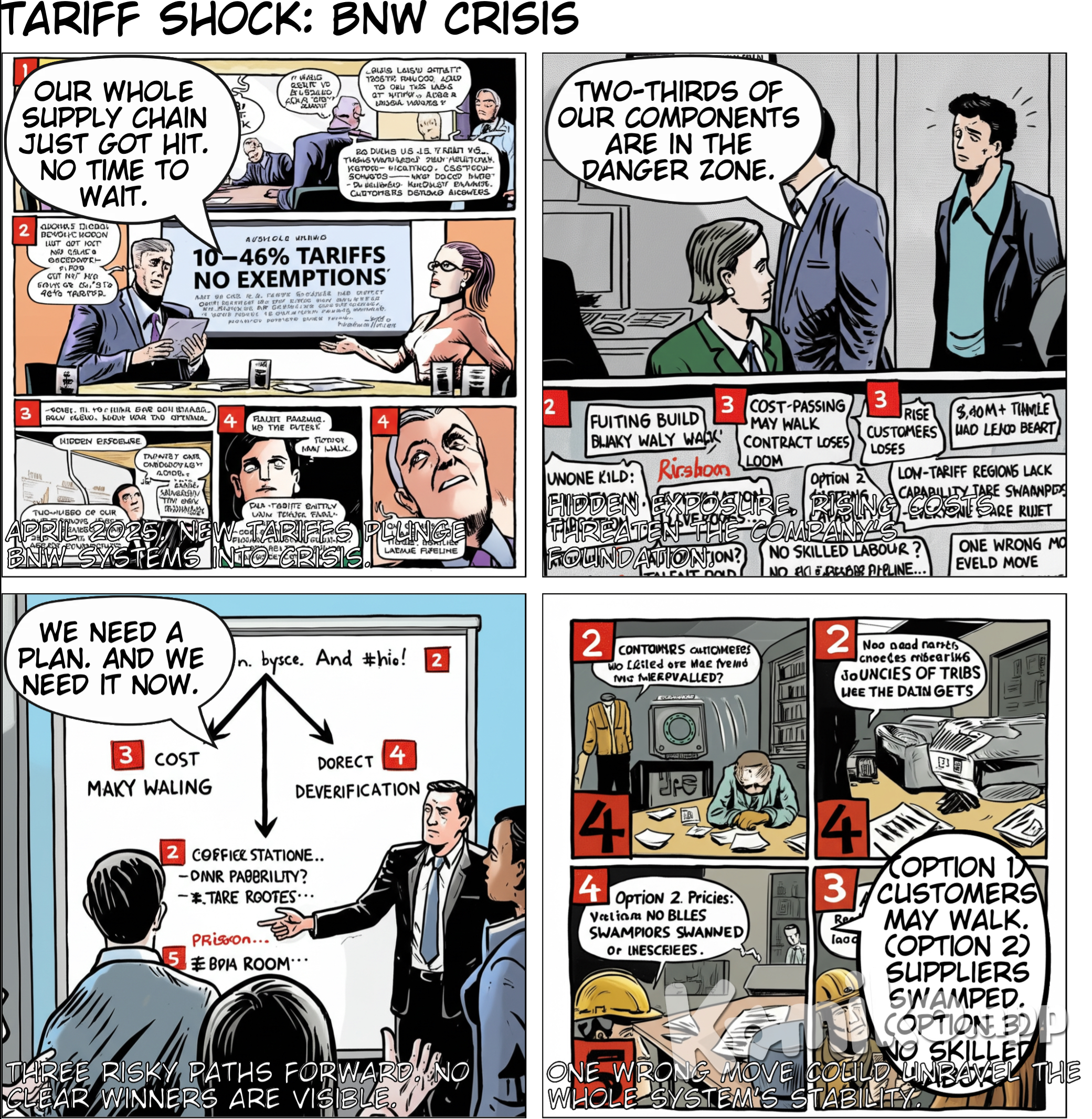

AI 藝術: Panel 1: “Tariff Shock” A conference room. A headline on a screen: “10–46% Tariffs Announced – No Exemptions.” Faces are tense. Narration: April 2025. A sweeping U.S. tariff package throws BNW Systems into crisis. Karen (CEO): “Our whole supply chain just got hit. No time to wait.” Narration: Global inputs—castings, motors, sensors—now face huge surcharges. Margins plunge. Customers demand answers. Panel 2: “Hidden Exposure” Martha (sourcing) holds up a spreadsheet. Mac (supply chain) looks grim. A graph shows rising costs. Martha: “Two-thirds of our components are in the danger zone—20% to 46% tariffs.” Mac: “Even our backups—Vietnam, Taiwan—aren’t safe anymore.” Narration: Domestic reshoring? Too slow. Talent pool? Already tapped out. Automation? Underfunded. Panel 3: “The Options” The team stands at a whiteboard with three arrows marked: Cost-Passing, Diversification, Domestic Build. Narration: Three risky paths forward. No clear winners. Karen: “We need a plan. And we need it now.” Panel 4: “The Risks” Close-ups of each path with risk overlays. Option 1: Raise Prices Customers may walk. Contract losses loom. Option 2: Diversify Supply Low-tariff regions lack capability. Everyone’s pivoting—suppliers are swamped. Option 3: Go Domestic $40M+ investment. Long lead times. No skilled labour pipeline. Narration: One wrong move could unravel the whole system.

創作者 snuggly unicorn

內容詳情

媒體資訊

用戶互動

關於此 AI 創作

描述

創作提示

互動

snuggly unicorn

snuggly unicorn

Panel 1: “Tariff Shock” A conference room. A headline on a screen: “10–46% Tariffs Announced – No Exemptions.” Faces are tense. Narration: April 2025. A sweeping U.S. tariff package throws BNW Systems into crisis. Karen (CEO): “Our whole supply chain just got hit. No time to wait.” Narration: Global inputs—castings, motors, sensors—now face huge surcharges. Margins plunge. Customers demand answers. Panel 2: “Hidden Exposure” Martha (sourcing) holds up a spreadsheet. Mac (supply chain) looks grim. A graph shows rising costs. Martha: “Two-thirds of our components are in the danger zone—20% to 46% tariffs.” Mac: “Even our backups—Vietnam, Taiwan—aren’t safe anymore.” Narration: Domestic reshoring? Too slow. Talent pool? Already tapped out. Automation? Underfunded. Panel 3: “The Options” The team stands at a whiteboard with three arrows marked: Cost-Passing, Diversification, Domestic Build. Narration: Three risky paths forward. No clear winners. Karen: “We need a plan. And we need it now.” Panel 4: “The Risks” Close-ups of each path with risk overlays. Option 1: Raise Prices Customers may walk. Contract losses loom. Option 2: Diversify Supply Low-tariff regions lack capability. Everyone’s pivoting—suppliers are swamped. Option 3: Go Domestic $40M+ investment. Long lead times. No skilled labour pipeline. Narration: One wrong move could unravel the whole system.

9 months ago